“No money down”, initially a free home, is often a very bad idea…

“No money down”, initially a free home, is often a very bad idea…

Quick disclaimer, confidentiality precludes me from knowing what advice other agents are giving their clients. They may initially say very stupid things to get your attention, only to give you better advice thereafter.

That does not matter though, as I’m here talking to you now, and we can forego their predatory advertising.

Buy a home with no money, sounds great!

I don’t blame you for being enticed by these grandiose claims of “no money down”, “buy a home with no money out of pocket”, “100% financing”, “buy a home for less than you can move into an apartment”, “free down payment assistance”, because frankly you could do all these things. It’s no lie. It’s the truth, well so long as you qualify for financing, lending programs are still available, etc etc etc. All things considered, this is one of the most commonly advertised offerings in US Residential Real Estate market right now and here’s why I think you should be cautious.

There are loan programs that offer 100% Loan to Value (LTV) financing. Skip the jargon, that means you can finance a home for the entire purchase price. You can even roll into your loan what little out of pocket expenses you would have seen. Your settlement statement, what you owe before you move into the home, can literally be zero dollars.

That means you can buy a home for less than you can move into an apartment. Although, no money down can quickly become a far worse decision than renting an apartment. We will get into that in a bit.

Lots of Real Estate Agents lead with this offer and frankly I choose to never do that. I feel bait and switch marketing is highly predatory and high LTV financing is seldom in client’s best interests. Let me explain why.

The facts about 100% financing

100% financing means you have NO equity. What is equity? Each month you make payments on your home, assuming you financed it of course. Four main items are paid in your monthly payment. Those are property taxes, insurance, principal, and interest. We will talk about the last two as those go to your bank.

Interest is the expense you pay for the benefit of using the bank’s money to purchase your home.

Principal is the money you actually borrowed the bank, the financed amount of your transaction.

Think of your home as a piggy bank. Assume your home’s market value, what a future buyer would pay, stays the same for the sake of this discussion. Each month you make a payment. A little bit of money goes into your piggy bank, the home’s principal balance, but most of that payment goes to the bank in interest.

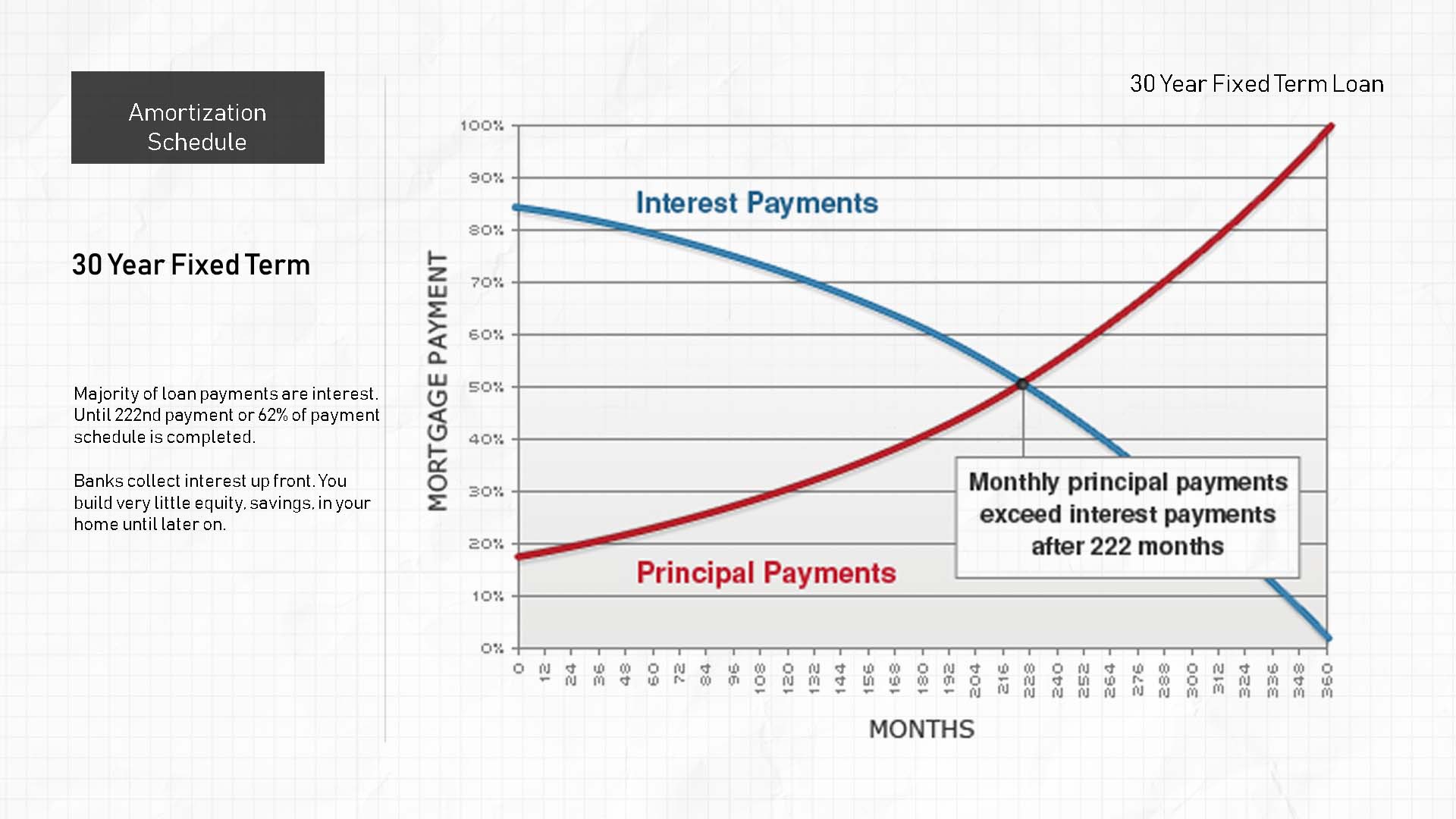

This ratio of principal to interest changes the longer you pay on your home, which is known as amortisation (see figure below). The bank charges a bulk of the interest up front so they can make their money sooner rather than later. They are not as interested in your piggy bank, so the bank schedules larger principal payments for later in the loan. This front loaded interest is the case of pretty well every loan outside of your rich uncle borrowing you money from the family fortune.

Owning a home with no Equity?

It takes a good 10 years to accumulate a decent amount of equity, money in your piggy bank / home, due to front loading of interest on loans. Yet, as an owner, you are liable for market swings, be it appreciation or depreciation.

Lets say you experience a hardship or simply want to move. This is when the shock hits you. Selling your home comes with expenses. Title fees, escrow fees, transfer taxes, HOA fees, commissions, recording fees these are all necessary expenses for you to sell your home. They are paid from that piggy bank, equity in your home. Side note I help my client’s leverage these fees to make money.

Let’s say you chose to do 100% financing, as opposed to having any equity when you purchase your home. That means, there is likely no money in the piggy bank to pay your transactional expenses. Unless the market shot up dramatically and or you are 10 or more years into your payment schedule.

This forces you to pay expenses out of pocket. Your other options are, perform a strategic foreclosure or short sale, both of which have far reaching consequences beyond impacting your credit worthiness. This includes ever changing legal and tax consequences. Lastly of course you could simply never sell the home and never move but these are seldom your choice.

Now how well is this 100% financing starting to sound?

Why take risks when you don’t need to?

You could rely on the market rising and building equity for you. This is always a great thing to have happen but what do you think lead to one of the greatest economic depressions in recent history, the subprime mortgage crisis?

People assumed the real estate market always goes up. They leveraged risky financing such as high LTV programs without thought as to otherwise. Then the market fell, banking system nearly collapsed, and everybody felt the pain homeowner or not.

Thinking that real estate appreciation is a sure bet is a bad idea. History has shown the best investors make highly informed decisions and always seek to mitigate potential risks. We too need to identify the risks, one of them being the market going down, and work to reduce them.

I encourage my clients put sweat equity into their homes. That is they find an ugly home, get it for under market value, then put a little work into it. This home, builds equity, not by payments or money down but through personal labor investment. Sweat equity is also one of the least risky pathways to wealth generation in Real Estate.

Another slightly less advantage scenario is, you simply have no plans on moving for a long time, the payment is affordable as in you can accumulate savings, you have a very secure income (disability, pension, trust fund money, etc), and no money to put towards a down-payment.

Should I make a down payment?

I typically encourage my clients put money down on the purchase of their home or at least have some money to leverage in the transaction.

Private mortgage insurance (PMI) covers the bank should you fail to pay off your loan. This system allows the banks to lend money without the associated risk of defaulting borrowers. Insured loans make sure banks never see losses and you pay for this insurance on their behalf. High LTV loans, over 80%, have an additional line item for PMI on the monthly statement. This line item can be in excess of $100 per month. Additionally, some banks charge more interest on high LTV loans due to their popularity.

High LTV loans can be very advantageous in certain circumstances. Buying a home on a whim without a second thought is a bad idea though. Most folks run with the first thing that catches their fancy only to later regret their decision. You need to take a little time to inform yourself before making such a big decision and weight all the factors involved. Not just being romanced by grandiose offers such as no money down, 100% financing, etc. Let’s start that discussion now so you have time to weigh all the opportunities at your disposal.